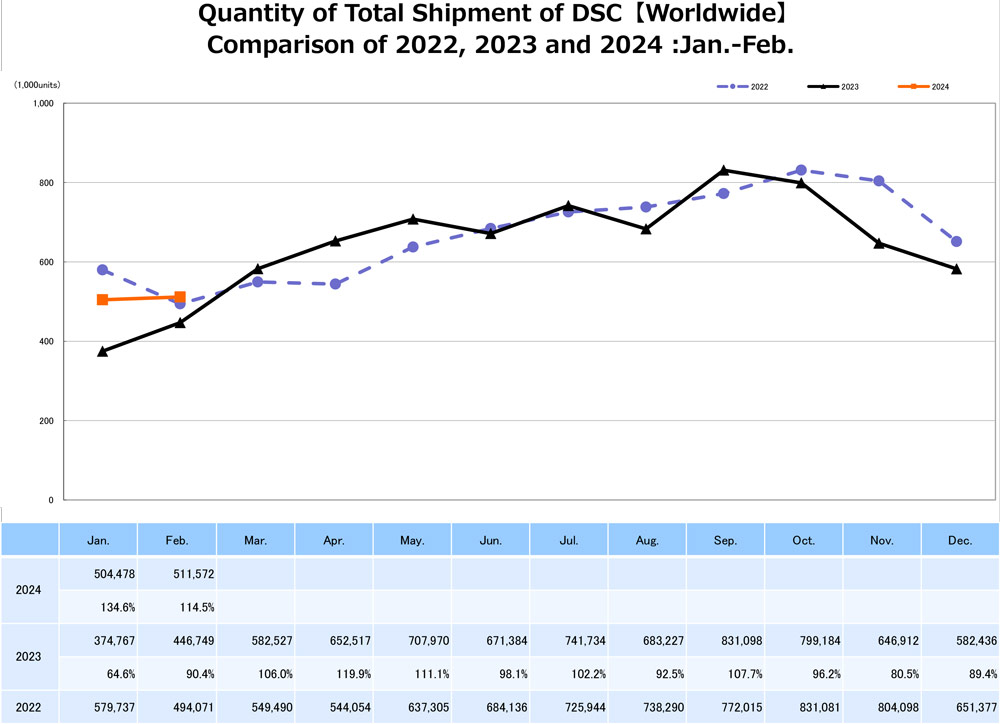

CIPA, the Camera and Imaging Products Association, is the trade body for Japanese camera and lens makers – its latest data for shipments of mirrorless cameras, DSLRs and compacts, has been released, covering February just gone.

CIPA charts are not the easiest to get to grips with, so having crunched the numbers, we have picked out the following interesting nuggets:

- 642,000 units of mirrorless cameras were shipped in February, a year-on-year increased of 43%.

- The total value of mirrorless cameras was shipped was ¥76.7 billion (about £402.5 million), an increase of 47% year on year.

- The total number of DSLR cameras shipped during February only went up by 2% to 136,700 but their value increased by a more impressive 10% to ¥6.81 billion (just over £35.7 million). While this seems odd, the logical conclusion is that prices of existing DSLR stock have risen, indicating makers are trying to milk the remaining market for as long as they can.

- It’s a similar story with compacts. While shipments remained flat year on year (a 0% rise, putting the shipment total at 237,4000) the value of these shipments grew by a whopping 28% to ¥12.31 billion (around £64.5 million). Again, we assume this is down to price rises or greater demand for premium compacts (the CIPA data doesn’t go into that level of detail).

- Mirrorless cameras increased their unit and shipped value-share of the total camera market to 82.4% and 91.9% respectively.

- When it comes to the value of shipped mirrorless cameras by region, China is now the biggest market (24.1%), with the Americas at 23.5% and Europe at 19.4%. This underscores the increasing importance of the Chinese market, and it will be very interesting to see how makers adapt their product lines accordingly.

Without getting too bogged down in the numbers, the take-home message from the February data seems to be that the demand for, and value of, mirrorless cameras continues to rise, with higher-end flagship models enabling makers to charge premium prices (although the income boost has to be set against the formidable R and D costs of getting higher-end kit to market in the first place).

The DSLR market, meanwhile, remains static, and the declines are, as yet, far from terminal. If prices of existing DSLR stock do rise, presumably this will encourage more people to buy ‘nearly new,’ thus helping the already buoyant market for used bodies and lenses.

It will also be interesting to see if all the hype around the Fujifilm X100VI will reinvigorate the compact market even further – Fujifilm is currently having to work very hard to keep up with the demand.

Other makers will be very aware of this, so could we also be about to see more ‘me too’ stylish, premium compacts from Fujifilm’s rivals?

Further reading

How to buy the Fujifilm X100VI

Higher-end mirrorless cameras boosting the market