Unit sales of CSCs dropped 9% in the first 47 weeks of 2015, compared to the year before, while unit sales of DSLRs fell 2.5% over the same period, according to Futuresource Consulting.

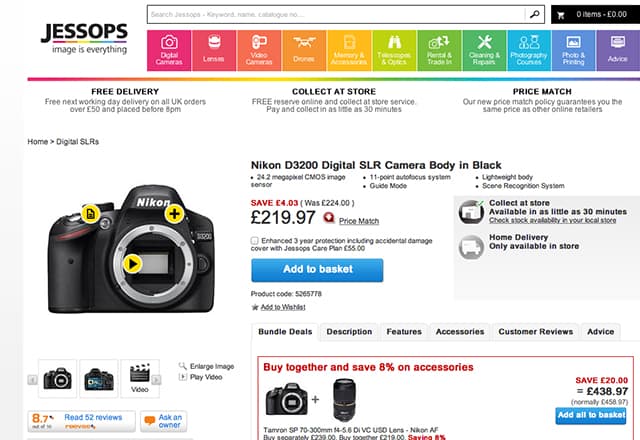

Tempting price deals on entry-level Nikon and Canon DSLRs – combined with fewer big promotions on CSCs than a year earlier – bit into mirrorless sales during 2015.

Imports of CSCs for sale in the UK will have fallen 10% in unit terms by the end of the year compared to 2014, with DSLR imports sliding 5%, Futuresource predicts.

By the close of 2015, DSLR imports are forecast to reach 354,000 units – more than three times that of CSCs, which are expected to have clocked up 100,000 for the 12 months.

Futuresource market analyst Arun Gill said: ‘Earlier in the year, we were expecting a relatively stable CSC market this year.

‘UK sell-out volumes were declining by around 15% in the first half [of] 2015, but improved slightly in the second half [to] around -10% year-on-year.

‘This decline was partly due to fewer aggressive promotions for CSC in 2015 compared with last year (e.g. Canon EOS M £199 deal), while there has been bigger focus on higher-value models this year.’

Gill added: ‘The DSLR market has performed slightly better than we had anticipated and this is due to aggressive pricing promotions from both Canon and Nikon, particularly for entry-level models.’

Although CSCs have potential for growth, this may be held back if Nikon and Canon fail to launch a professional-level CSC, asserts Futuresource.

‘We believe that a more rapid uptake of CSCs is likely to be inhibited by a positive perception and preference towards the DSLR format and the key brands in this segment, respectively, particularly among entry-level users,’ said Gill.