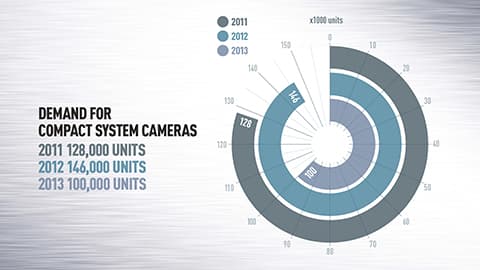

Above graphic, UK Only; Data source: GfK

Video: AP news editor Chris Cheesman reports on the future for CSCs, interviewing industry experts and consumers

Amid great fanfare, the first compact system camera (CSC) was born in 2008.

The micro four thirds Panasonic Lumix DMC-G1 ignited a fierce turf-war with the traditional DSLR which recently saw the first full-frame CSC – the Alpha 7 – join a growing army of technology-laden upstarts.

CSCs – aka ‘mirrorless cameras’ (among a host of other names they have assumed since) – were heralded as easier to use and, with the absence of an SLR mirror-box, less bulky than a DSLR.

Yet, more than four times as many SLRs were sold in the UK last year than CSCs which notched up sales of just 100,000 units – 46,000 fewer than the year before, according to figures released by market research firm GfK.

Do people really care which format they buy?

Duncan Schwier owns both a CSC and DSLR – a Panasonic DMC-GF1 and Canon EOS 5D Mark II.

AP caught up with Duncan at Park Cameras’ new store in central London.

Duncan says he carries the GF1 as an ‘opportunist camera’ for candid shots, but not when he is “going out to take a photograph”‘.

He explains that his DSLR encourages him to think about the photograph – as part of a ‘more intellectual process’ – rather than just taking what’s in front of him.

A dedicated enthusiast since student days, he tells AP: ‘I find the smaller camera a little fiddly sometimes … you’ve got to rummage through the menus to find what you are after.’

That said, when his niece wanted a system camera, Duncan recommended she buy a GF2 ‘simply because it was cost-effective, she would have a lot of fun with it and it goes in a handbag’.

Confusing category names

Fellow enthusiast Paul Dowker, who has been taking pictures for 16 years, bought a CSC to complement his ageing DSLR.

‘I’ll take my compact system because it’s new and has more megapixels… but it is also so much easier to use.’

Though now an experienced enthusiast, Paul believes the term ‘CSC’ is confusing to people new to photography.

This may be a prime reason for slumping sales.

‘When I first started, a “compact camera” was a small point and shoot.

‘Now you have the “compact system”. I think people get confused over what is a digital compact pocket camera and a decent semi-pro piece of kit.

‘So, maybe some polishing up of the terms and phrases [is needed],’ he says.

This view is echoed by Pete Sharpe, manager of Park Cameras store in London.

‘I think everybody knows what a DSLR is – it’s a catch-all term for digital SLRs. But CSC cameras get called all sort of things.

‘It would be nice if all the brands can all agree on one title for that type of product.’

Richard Gregory, GfK account director for Consumer Electronics adds: ‘It’s difficult for consumers to understand sometimes exactly what it is they are buying and what the differences are.

Richard Gregory, GfK

‘On the face of it, it’s a large SLR versus a small SLR [style-camera] and maybe the marketing and the education needs to move that way’.

‘Generic term is DSLR’

Part of the problem, suggests Nikon, is consumers not regarding CSCs as a separate category in the way manufacturers do – leading them to plump for a DSLR instead.

Hidehiko Tanaka, managing director of Nikon UK, said recently: ‘I feel that, in this country, if [customers] want a camera with an interchangeable lens, they are thinking of the traditional SLR…’

Adding to the confusion, CSCs are at sometimes incorrectly referred to as ‘DSLRs’.

‘Consumers are not shopping for CSC because the generic term of the category is DSLR,’ notes Panasonic’s Barney Sykes, UK product and marketing manager for Lumix G.

While Nikon says it wants to more clearly target the format towards specific customer needs – citing the ‘waterproof’ AW1 version of the Nikon 1 as a case in point – Panasonic has pledged to go a step further, repositioning CSCs as a ‘top-end’ product.

This was signalled by the early unveiling of the DMC-GH4 earlier this month. Armed with 4K video it appears to have been announced way ahead of the camera’s availability, serving as a statement of intent.

Despite an explosion of CSCs from electronics wizards such as Panasonic, Sony and Samsung, DSLRs continue to dominate a market driven by the two biggest camera brands, according to Sharpe.

‘We are a country of traditionalists,’ he asserts.

‘You’ve got the big boys like Canon and Nikon who are doing very well… But these brands don’t have the most successful compact system cameras and, for whatever reason, [consumers] are still hanging on to the glory days of Canon and Nikon.

‘I think they largely have this idea that it’s got to be a Canon or a Nikon because that is what they have been told to buy, by a friend.

‘So, even though CSCs have lots of benefits, I think we are struggling still to treat technology companies as serious camera brands.’

‘Wider accessory range’

Crucially perhaps, notwithstanding the enthusiasm of retail staff to promote CSCs, Sharpe points out that DSLRs are more attractive to shoppers as they offer a wider range of accessories.

Olympus, Panasonic and Sony-made CSCs have proved popular at Park Cameras, but Sharpe urges manufacturers to ‘start exploring the virtues of the CSC’, over a DSLR.

‘The vast majority of CSC converts are doing it because they are fed up with carrying around a big bag full of stuff… the cameras themselves are smaller and lighter but all the accessories like the flashguns and lenses are too…

‘You often see that cut-out outline of a DSLR body with a CSC inside it. But you don’t see this as much now as you did at the beginning.’

GFK’s Richard Gregory points out that it may be unfair to focus purely on compact system cameras when DSLR unit sales also fell (albeit only by 11%).

And he explains that prolific CSC promotional activity by camera makers in the previous year, means sales results for 2013 paint a gloomier picture than CSCs deserve.

Panasonic largely blames the disappearance of Jessops stores under former owners in January 2013 for a drop in its CSC sales – though it refuses to say how much they fell.

Jessops’ disappearance from the high street under former owners hit sales nationwide

‘The other impact… was that, all of a sudden, Samsung gave a free tablet away… which, arguably, just artificially exploded the market…’ says Sykes.

Blurred lines

The prevalence of the bottom-end DSLR, which may not boast all the technological advances of a CSC, but may be considerable cheaper, is also a threat.

Sykes stresses that CSCs cannot compete, in price terms, against a £399 twin-lens DSLR kit from [general consumer electronics stores], for example.

‘The lines are getting blurred, especially with price,’ concurs GfK’s Richard Gregory.

‘We track body-only sales. Sub-£300 SLR cameras have grown, as a proportion, quite significantly, especially in Q4 [of 2013] … ‘That’s going to start to challenge compact system camera average prices.’

Panasonic recognises it must act now to drive up sales and Nikon UK freely admits it has more work to do to highlight the benefits of the compact form.

‘For the first four years, maybe a lot of the CSC brands tried to sell volume. That may not have been the right approach. Now, we are going to try to add features and benefits and educate the consumer,’ says Sykes.

Education, education…

Successful marketing of CSCs, through online education, may be the key to future success given that internet sales account for more than 40% of imaging market’s value, according to GfK. This compares to an average of 20% for the consumer electronics industry.

However, Gregory points to the difficulty in relaying the benefits of CSCs through a web page when, a few years ago, ‘we saw the majority of people going in store, getting that advice and being able to act on it’.

As part of its campaign Panasonic has this month gone as far as imploring photography journalists to conduct reviews of CSCs ‘against DSLRs’, rather than testing like with like.

The self-promotion project appears to be paying dividends. A seminar by professional photographer David Eustace, who uses a Panasonic GX7, proved so popular that organisers were forced to ‘turn people away’ from a recent event at the Peter Jones store in Chelsea.

‘They [students] said they didn’t even know this technology existed. They assumed the only camera they could use was a DSLR,’ says Sykes who remains optimistic on the back of encouraging CSC sales figures for early January.

Growth signs

‘Compact system camera is now returning to a period of growth which is really pleasing…’ Sykes enthuses.

Likewise, Fujifilm and Olympus will have welcomed figures released in the past few weeks suggesting that the Fuji X-E2 and flagship Olympus OM-D E-M1 each played a key role in reviving the firms’ respective camera divisions – cutting losses by 60% in each case.

‘Our research tells us that 48% of consumers who bought a DSLR in the past two years… would now consider a Lumix G,’ adds Sykes.

‘Compact system since week one of 2014 has actually shown growth, versus 2013,’ confirms GfK’s Richard Gregory.

But, he cautions: ‘We need to realise that some of that is down to the retail landscape.

‘Obviously we saw Jessops go out of business at the beginning of 2013 and so it’s going to be a few weeks before we can see that there’s been an uplift in the category.’

GfK forecasts a 5% rise in all system camera sales in the UK this year, plus a rise in interchangeable-lens camera sales worldwide if figures for North America are stripped out.

Park Cameras’ Pete Sharpe remains guarded, however. ‘From my experience we are still selling a lot of Canon and Nikon. CSC sales are definitely increasing – but the majority of interest still seems to be in DSLR.’